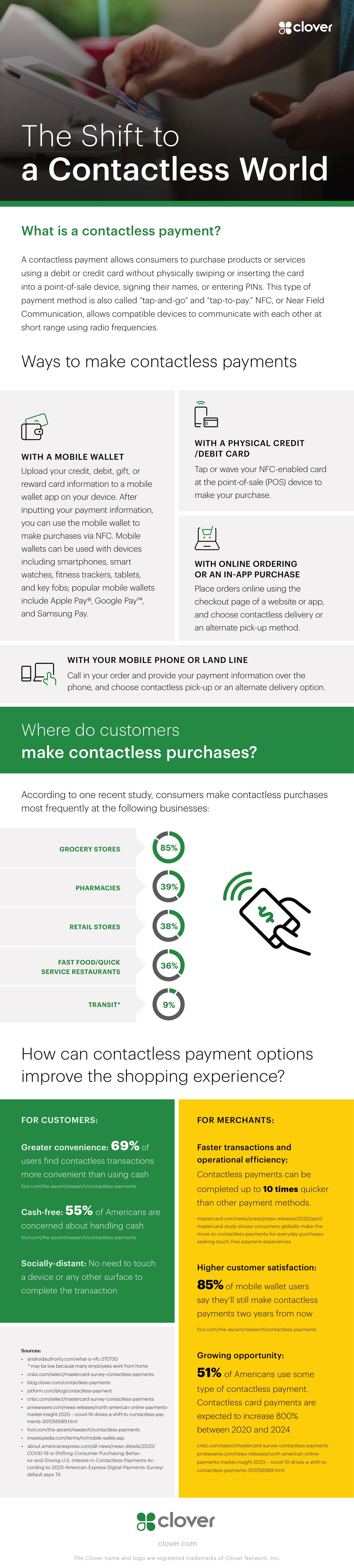

The Shift to a Contactless World

With contactless payment technology, your clients can complete their transactions without ever having to physically swipe, dip, or hand a credit card over when using your point of sale (POS) terminal.

This article explains different ways you can use contactless payments at your business, and also covers some of the key benefits that this payment technology offers – both for clients and for merchants.

How to use contactless payments

Contactless payments rely on a shortwave radio technology, known as near field communication (NFC), to establish a wireless connection between a client’s credit card or mobile phone and a merchant’s POS device. NFC is similar to Bluetooth, but it only works across very short distances.

Once contactless payments are enabled, your clients simply wave or tap their NFC-enabled payment device over your POS terminal to initiate a transaction – whether that payment device is a:

- Credit card

- Debit card

- Smartphone

- Tablet

- Wearable device

Most modern POS terminals come equipped with NFC capabilities – along with standard support for magstripe and chip cards. As such, you may be able to start accepting contactless payments without making substantial hardware upgrades. Even if your current terminal doesn’t support the technology, many smartphones and tablets can be converted into portable POS devices that can pair with inexpensive NFC-enabled mobile card readers.

What are the advantages of using contactless payments?

Contactless payments offer several benefits for clients and merchants alike.

- At a time when many Americans have concerns about handling cash, contactless payments represent a convenient option. In fact, clients can ditch their wallets entirely if they have their credit, debit, or gift cards stored in mobile wallets on NFC-enabled smartphones or wearable devices like smartwatches or fitness trackers.

- Similar to QR code menus in restaurants, contactless payments help to promote a more health-conscious environment, which is increasingly important in a world where people are a lot more concerned about touching communal things.

- Contactless payments are up to 10 times faster than other payment options, which can help lead to shorter lines, higher overall satisfaction among your clients, and more sales per hour.

Conclusion

Contactless card payments are expected to grow by 800% from 2020 to 2024, and this staggering number doesn’t even include contactless payments made through mobile devices, wearables, and other fintech innovations.

For many businesses, this growth is reason enough to begin offering contactless payment options to their clients. In fact, there’s a good chance that most of your clientele already uses some type of contactless payment technology for personal or other business-related purchases.

If you’re looking for additional reasons to offer contactless payments, download the free infographic below. It covers some of the driving forces behind contactless payment’s growing popularity across many different industries.

Infographic created by Clover, a POS system provider

More to Read:

Previous Posts: